The United States has long been a global leader in innovation and production, focusing on high-value exports such as aerospace and biotechnology products while outsourcing the mining of raw materials and intermediate goods manufacturing to the rest of the world. The pandemic has exposed the flaws of such a fragile system as global supply chains froze up, creating a mismatch between goods production and consumption. As a result, there has been a push to “reshore” or bring back critical manufacturing to North America. From semiconductors and green technology to pharmaceuticals, we are in a new age of industrial policy in the U.S., which will significantly increase the amount and variety of goods produced domestically.

Case in Point: The CHIPS and Science Act of 2022.

The CHIPS and Science Act of 2022 provides $280 billion in new funding to boost the domestic research and manufacturing of semiconductors and related technology in the U.S. This has jump-started a massive increase in manufacturing spending, which has doubled since the end of 2021.

At an annualized rate, more than $140 billion in manufacturing construction spending is occurring to produce new high-technology manufacturing plants. Nearly half of this construction spending is concentrated in Arizona and Texas, which are quickly becoming the fastest-growing centers of U.S. manufacturing. Since 2020, the manufacturing workforce of Arizona has grown by 20,000 (9%), with Texas adding 114,000 manufacturing jobs (13%) over this same time period. Once these high-technology manufacturing plants are built, new business ecosystems will grow, with these manufacturing clusters expected to attract additional employment and investment dollars.

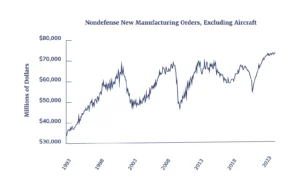

While this surge in manufacturing construction spending will lead to increased domestic output in the future, there is already strong demand for U.S. manufactured goods, with new orders for capital goods from domestic manufacturers at record highs.

From post-pandemic supply chain resilience to increasing trade tensions with Russia and China, macroeconomic forces have led to increased federal investments in rebuilding the U.S. industrial base. This new focus on industrial policy seeks to reverse decades of offshoring and outsourcing and will necessitate large injections of capital into U.S. manufacturing.

Demand for U.S. manufacturing expected to positively impact other industries as well.

These high-technology investments will be concentrated in a handful of regions, and while they may be dominated by big-name companies like TSMC and Intel, many thousands of smaller companies will be needed downstream to support the growth of these high-technology clusters.

Since our current logistics and energy infrastructure was not designed to handle the demand of this increased manufacturing boom, additional investment will be required in both energy infrastructure and changing logistics patterns for roads and railways to bring raw materials in and ship finished goods out, creating indirect growth in seemingly unrelated construction and manufacturing companies. This includes the CRE industry, which will see increased activity to support growing demand.

The next 40 years of manufacturing in the U.S. will look nothing like the previous 40. We are currently transitioning to what could very well be the second U.S. industrial revolution.

Stay tuned!