Throughout Atlanta’s history, many Atlanta businesses have been drawn to Downtown, Midtown and Buckhead to access most of the daily conveniences one would need, limiting extensive travel during the traditional workday. While cars and other forms of transportation have allowed commercial and residential development to explode “OTP” (into the suburbs) over the last fifty years, the suburban office model is experiencing an existential moment. And, despite considerable Atlanta-region infrastructure projects (such as the $1B+ I-285/GA-400 reconstruction) that will aid access and mobility for a large section of the northern suburban office market, gone are the days where office deals are decided in the suburbs by quantitative metrics like rental rates, improvement packages and surface parking ratios alone.

Business owners and executives tasked with making the “office of the future” decisions are seeking something more qualitative—a sense of community delivering authentic energy. Community can be found in vibrant mixed-use environments that serve as a platform for consistently productive, healthy, and sticky office workers. While Midtown Atlanta (and by extension West Midtown and the Eastside Beltline district) has led Atlanta office leasing during the last 10 years given the authentic vibrancy and walkable conveniences those areas deliver, the suburban mixed-use model has arguably been equally as impressive in Atlanta, although not as widely publicized. Regardless of consistent rental rate increases, companies are relocating to (or renewing at) suburban mixed-use developments where work, life, and play are integrated.

We’ve seen the following developments outperform in Suburban Atlanta over several years now – examples include (1) Avalon in North Fulton (including those walkable office properties within a 0.5-mile radius), (2) The Battery (home to the Atlanta Braves) and by extension the Galleria in Cumberland, and (3) Forum Peachtree Corners. Further, given the lack of available/suitable land combined with one of the most challenging capital market eras of our time, these existing mixed-use projects will only continue to “lap the field”.

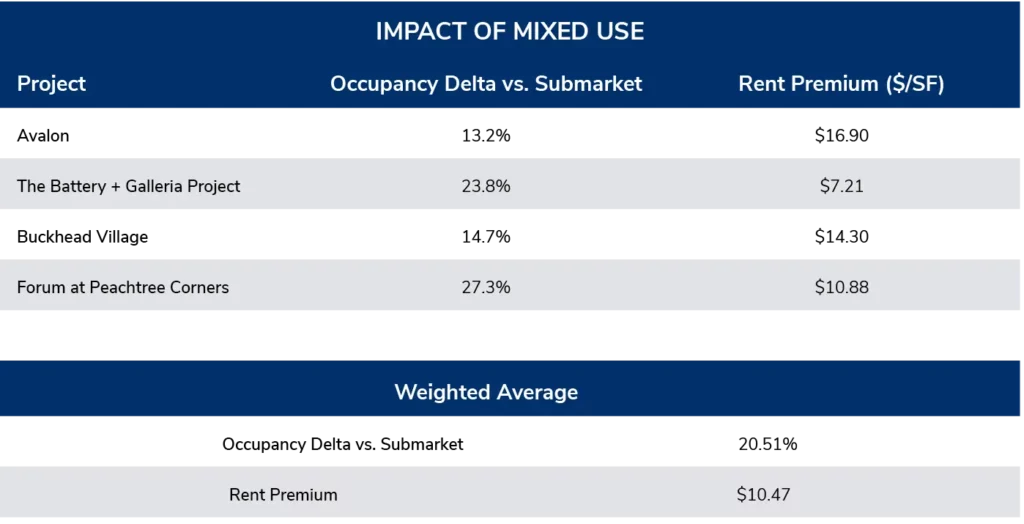

All these examples feature office components experiencing record-breaking rental rates and occupancy levels significantly outperforming their respective submarkets. As a corollary, the difference between office performance around (4) Buckhead Village and the rest of Buckhead is also striking. On average, these four examples showcase a 16.2% higher occupancy level and a rental rate premium of over $13 per square foot.

Here at Stream, we represent a significant office component of Avalon (PGIM) and Forum Peachtree Corners (North American Properties/Nuveen). We are also marketing future mixed-use projects in the suburbs, including Continuum Alpharetta (Southwest Value Partners), Medley Johns Creek (Toro Development Co), and Six West College Park. Because of our direct relation to these projects, we see the considerable contrast in activity first-hand.

Of the current suburban developments planned or under construction in Atlanta, literally every project containing office is mixed-use (not including build-to-suit or medical offices). Furthermore, well-located (but otherwise commodity) suburban office buildings currently orphaned from the rest of the market are leveraging one of the best retail markets to lure food & beverage operators to increase office leasing activity. Adding on-site food from well-known national and local operators can be a game changer for the office project’s brand and leasing momentum (take the Vantage project at Northcreek led by Ford Fry’s popular Little Rey concept for example).

While each suburban mixed-use project features its own trademark “draw,” there are several core features driving interest for residential developers, retailers, chefs, and office users:

- Community Atmosphere: Mixed-use developments foster a sense of community due to the interaction between residents, workers, shoppers, diners, and hotel/convention visitors alike. This community atmosphere can contribute to a more pleasant and engaging work environment and lead to incredible loyalty (in the form of repeat visits).

- Convenience: The availability of residential units, restaurants, and stores on-site provides a high level of convenience for office tenants. Employees can live, work, and access essential services within the same complex, reducing commuting time and stress.

- Amenities: Of course, mixed-use developments often offer a variety of amenities such as restaurants (often chef-driven and fast-casual restaurants together), grocery stores, fitness centers, recreational spaces, green areas, and possibly even entertainment options. These amenities can enhance employee satisfaction and well-being.

- Brand Image: Businesses in mixed-use properties can benefit from the association with a vibrant and dynamic environment, enhancing their brand image and appealing to clients and customers.

- Diverse Talent Attraction: The presence of various facilities and services can attract a diverse range of talent. People are more likely to be interested in working in an environment that offers a variety of lifestyle amenities.

- Networking Opportunities: Shared spaces like restaurants and common areas encourage spontaneous interactions among employees, residents, and customers from various businesses. This can foster collaboration, innovation, and networking.

- Increased Foot Traffic: The presence of retail stores and restaurants can lead to increased foot traffic, potentially benefiting businesses in the development, including customer-facing office tenants. This foot traffic contributes to a vibrant and bustling atmosphere.

- Flexible Work Arrangements: With mixed-use properties, co-working spaces tend to perform better given a higher achievable monthly rent to support build-out costs and due to the stickiness of “captive” residents and a transient workforce.

- Environmental Considerations: Mixed-use developments often emphasize sustainability and efficient land use. By minimizing the need for extensive commuting and promoting energy-efficient practices, these properties can align with corporate sustainability goals. Most mixed-use properties feature abundant EV charging stations, for instance, which we expect that trend to continue in a big way.

- 24/7 Security: Mixed-use developments often have round-the-clock security services due to the presence of retailers and residential units. This can enhance the safety and security of the entire property, including the office spaces.

In addition to mixed-use developments, adaptive reuse projects are also on the rise, with estimates predicting that 90% of development over the next decade will likely involve renovating or reusing existing assets. This is mainly due to the lack of developable land in major metro areas and the environmental benefits these projects deliver. With consumer behavior shifting towards mixed-use developments, adaptive reuse may play a role as communities are transformed into new, vibrant areas that continue to foster this “live-work-play” mentality.

As markets continue to shift and change, one thing is certain: people will flock to what makes their lives more relevant and enjoyable, with businesses locating where top talent is. This means that the future for mixed-use developments—in Submarket Atlanta and beyond—is not only promising, but essential.